Customer Segmentation plays a key role in profitability,

India is a land of diversity . We rejoice in the culture of multiplicity . Given the diverse work opportunities that have been created in the booming economy , people now have a multi dimensional profile . How do marketing teams then create customer segments ?

Creating customer segments in now dependent on a variety of factors depending on the nature of the business. It is common sense that a jewellery retailer would segment the market differently as compared to an FMCG retailer. The entire exercise of customer segmentation would be conducted differently for either of these businesses.

A popular new age business that is known for its success is the Food Delivery business. Let us understand how we can look at Customer Segmentation for this business.

In today’s fast-paced world, food delivery companies have become an integral part of our lives. With the convenience of ordering food from the comfort of our homes, it’s no wonder that the food delivery industry has grown rapidly over the past few years. However, with the increasing competition in this industry, it has become crucial for food delivery companies to understand their customers and cater to their needs effectively. It is not just about the allocation of delivery resources but also important to understand the placement of partner cloud kitchens . This is where customer segmentation comes in.

Customer segmentation refers to the process of dividing customers into groups based on their characteristics, needs, and preferences. By segmenting customers, food delivery companies can better understand their customers’ behaviour and tailor their offerings to meet their specific needs. In this blog post, we will discuss how food delivery companies can use customer segmentation to their advantage.

Geographic Segmentation

One of the most basic forms of customer segmentation is geographic segmentation. This involves dividing customers based on their location. For example, a food delivery company operating in India can divide its customers based on areas in the city or region they are in. This allows the company to tailor its offerings to meet the specific needs and preferences of customers in each region.

For instance, customers in certain pockets of Mumbai may prefer spicy food, while other pocket customers may prefer milder flavours. By understanding these area wise differences, food delivery companies can offer menus that cater to the specific tastes of their customers. Moreover, they can also target their marketing efforts to specific regions for a specific kind of cuisine to increase their reach and visibility.

Demographic Segmentation

Another important form of customer segmentation is demographic segmentation. This involves dividing customers based on demographic variables such as age, gender, income, education, etc. For example, a food delivery company may find that its customers in the age group of 18-25 prefer fast food or trendy cuisines, while customers in the age group of 40-50 prefer traditional cuisine.

By understanding these demographic differences, food delivery companies can offer menus that cater to the specific needs and preferences of each demographic group.

Also, take ideas from our previous blog on: Consumer Profiling Can Help You Elevate Your Business in 5 Ways

Psychographic Segmentation

Psychographic segmentation is another important form of customer segmentation. This involves dividing customers based on their lifestyle, interests, and personality traits. For example, a food delivery company may find that its customers who are health-conscious prefer organic or low-calorie food, while customers who are adventurous may be more willing to try new and exotic cuisines.

By understanding these psychographic differences, food delivery companies can offer menus that cater to the specific needs and preferences of each psychographic group. They can also target their marketing efforts to specific psychographic groups to increase their reach and visibility.

Behavioural Segmentation

Behavioural segmentation involves dividing customers based on their behaviour or purchasing patterns. For example, a food delivery company may find that its frequent customers order food at least twice a week, while customers who have not ordered in a while may need a little incentive to come back.

By understanding these behavioural differences, food delivery companies can offer personalized discounts or loyalty rewards to their frequent customers to keep them coming back. They can also target their marketing efforts to customers who have not ordered in a while with promotional offers to entice them back.

Occasion-based Segmentation

Occasion-based segmentation involves dividing customers based on the occasion or reason for their order. For example, a food delivery company may find that customers ordering food for a party or special occasion may have different requirements and preferences than customers ordering food for themselves on a regular basis.

By understanding these occasion-based differences, food delivery companies can offer menus and packages that cater to the specific needs and preferences of customers for each occasion.

In conclusion, customer segmentation is an important strategy for food delivery companies to effectively cater to their customers’ needs and preferences.

Kentrix offers a simple solution which provides data up to an individual residential building precision.

Kentrix is an Inclusive Business Intelligence Platform for consumer data-driven solutions in B2C and D2C, operating on data of 91.5 crores of Indian consumers.

They are identified down to the precise residential place of living.

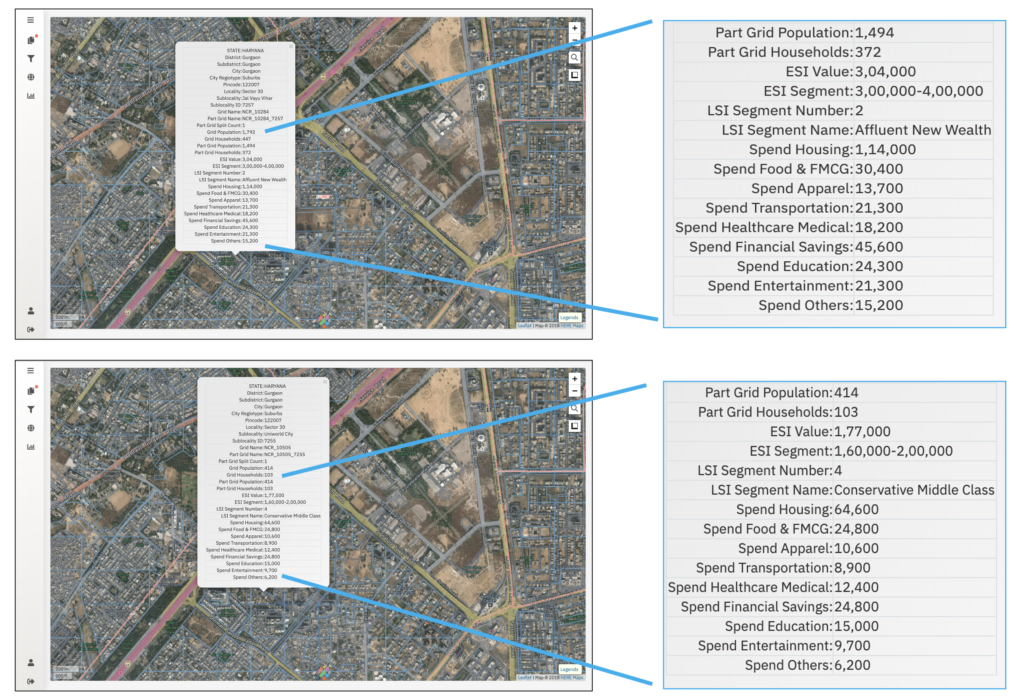

Geomarketeer from Kentrix is a granular market segmentation analysis tool. It supports companies in India with geo-location-based intelligence, using micro-market-focused data and tools to sustainably grow their business.

Also, take ideas from our previous blog on: How Data plays a key role in D2C businesses

By delivering this information on the Software as a Service (Saas) platform, Geomarketeer allows organizations of any size to quickly get started with market research and data-backed insights.

The important part of the tool is that it will not just allow you to check Customer-Product Affinities but also Understand where, up to an individual residential building precision, is the right target for a specific product.